rhode island income tax rate 2020

Rhode Island Income Tax Rate 2022 - 2023. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island also has a 700 percent corporate income tax rate.

. The federal corporate income tax by contrast has a marginal bracketed corporate. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. Household income location filing status and.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Your average tax rate is 1198 and your. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island Income Tax Calculator 2021. Tax Rate 0.

Any income over 150550 would be. Detailed Rhode Island state income tax rates and brackets are available on. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. The average effective property tax rate in Rhode Island is the 10th-highest in the country though. Rhode Island Tax Brackets for Tax Year 2021.

Detailed Rhode Island state income tax rates and brackets are. Detailed Rhode Island state income tax rates and brackets are available on this page. Find Rhode Island income tax forms tax brackets and rates by tax year.

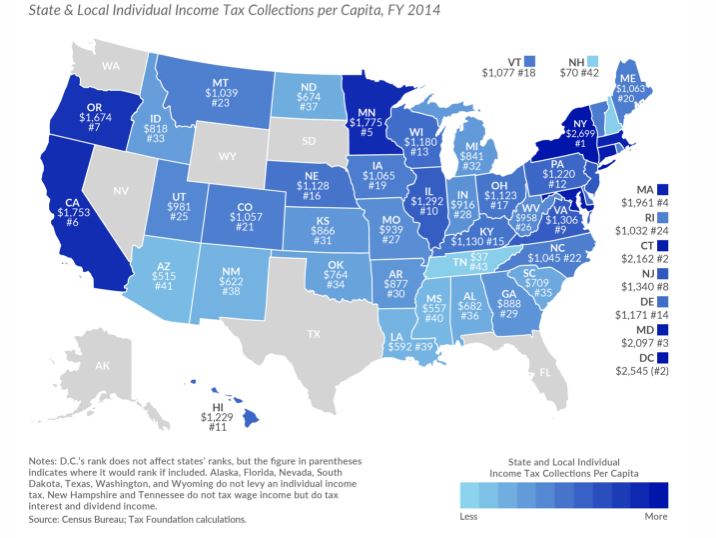

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Islands income tax brackets were last changed.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Find your income exemptions.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. Rhode Island Tax Brackets for Tax. Rhode Island has a.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. Detailed Rhode Island state income tax rates and brackets are available. Rhode Islands tax brackets are indexed for.

The state does tax Social Security benefits. The rate so set will be in effect for the calendar year 2020. Start filing your tax return now.

Residents and nonresidents including resident and. Interest on overpayments for the calendar year 2020 shall be at the rate of five percent 500 per annum. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Find your pretax deductions including 401K flexible account. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

TAX DAY IS APRIL.

Sales Tax On Grocery Items Taxjar

What S At Stake In Rhode Island S Upcoming Political Primaries The Boston Globe

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Income Tax Calculator Smartasset

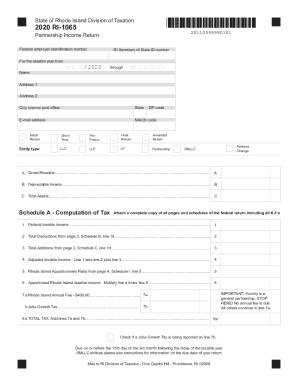

2019 Ri 1065 Form Fill Out And Sign Printable Pdf Template Signnow

Ri Retail Sales Permit Renewal Fill Out And Sign Printable Pdf Template Signnow

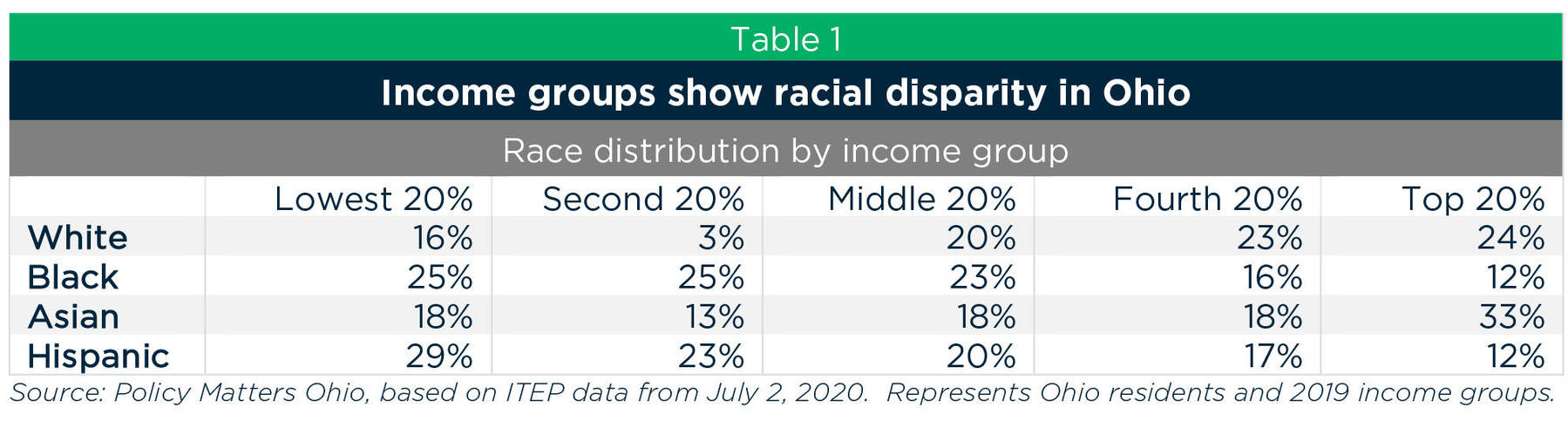

Rebalance The Income Tax To Build A Better Ohio For Everyone

Ri Health Insurance Mandate Healthsource Ri

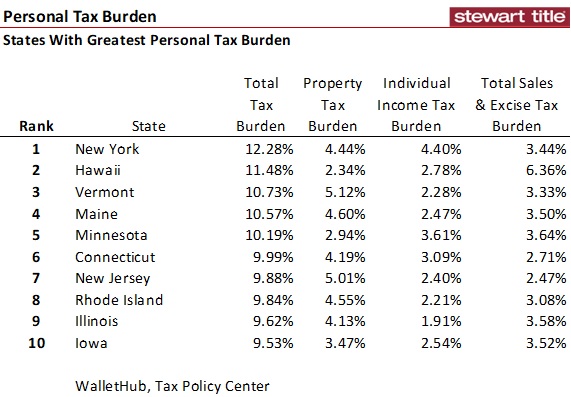

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

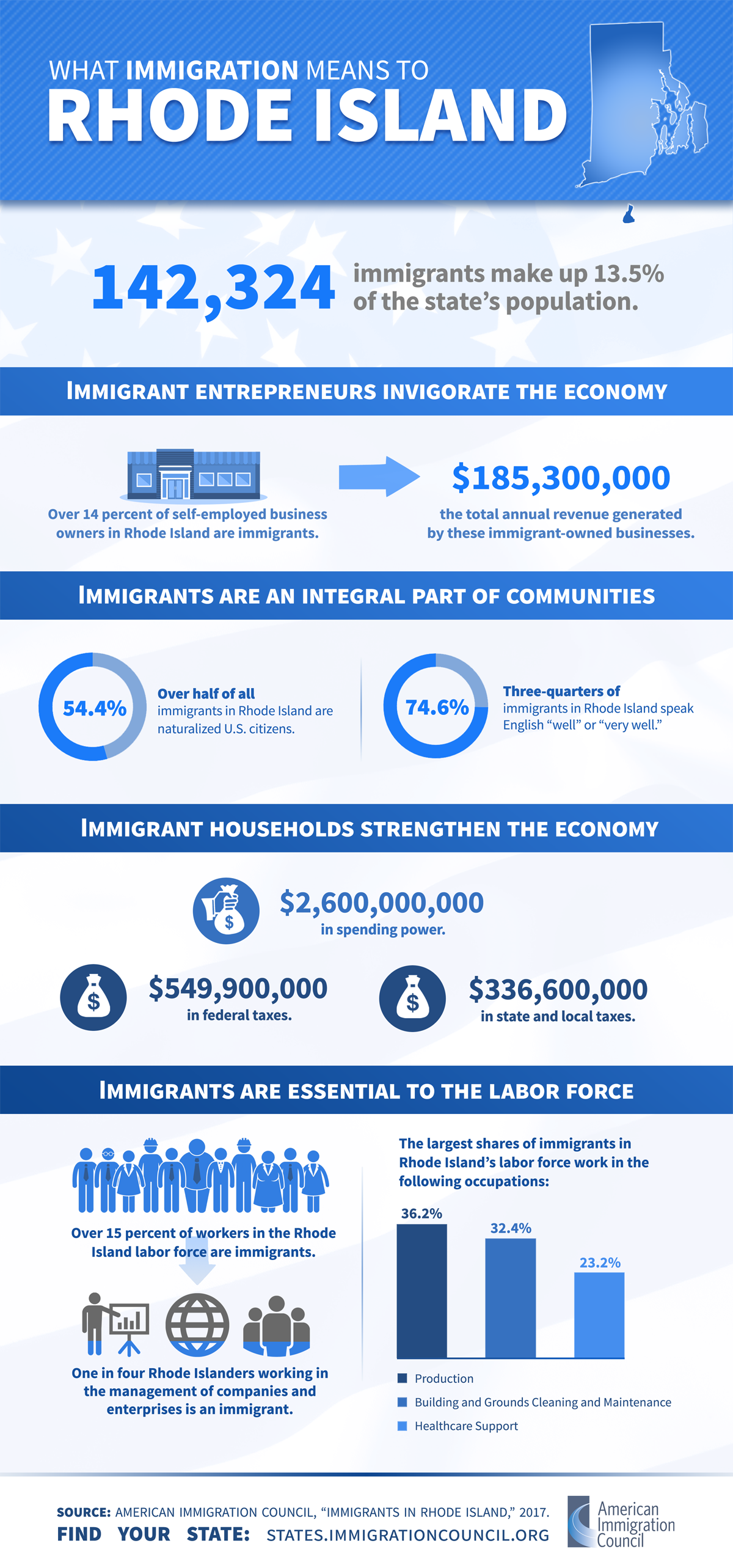

Immigrants In Rhode Island American Immigration Council

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island State Tax Tables 2020 Us Icalculator

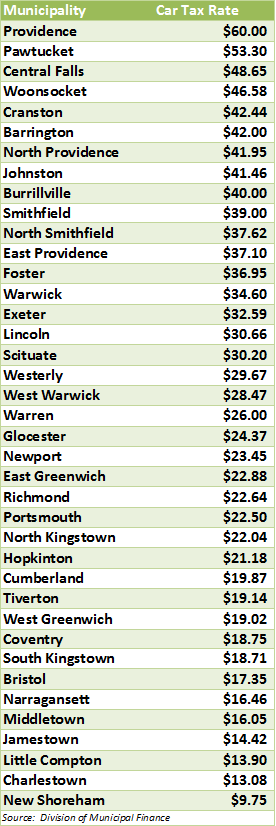

Golocalprov The Highest Car Taxes In Rhode Island

Individual Income Tax Structures In Selected States The Civic Federation