tax forgiveness credit pa schedule sp

8 Go-To Resources About Tax Forgiveness Credit Pa Schedule Sp. We Can Help Suspend Collections Liens Levies Wage Garnishments.

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

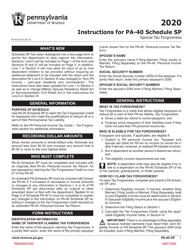

The PA Schedule SP will produce if the TP SP qualify.

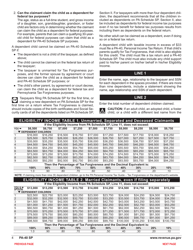

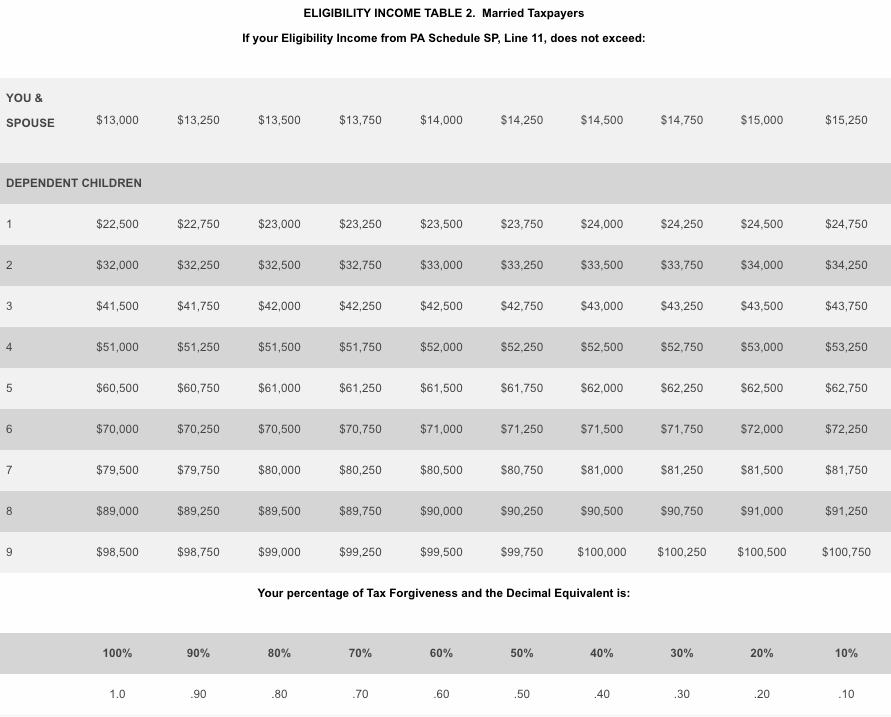

. A dependent child with taxable income in excess of 33 must file a PA tax return. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Find Fresh Content Updated Daily For Tax forgiveness pa.

A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP. Check Out the Latest Info. The IRS Can be Very Reasonable if You Know How They Work.

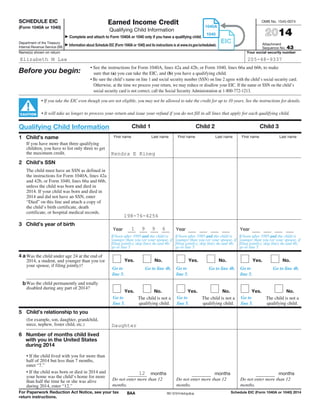

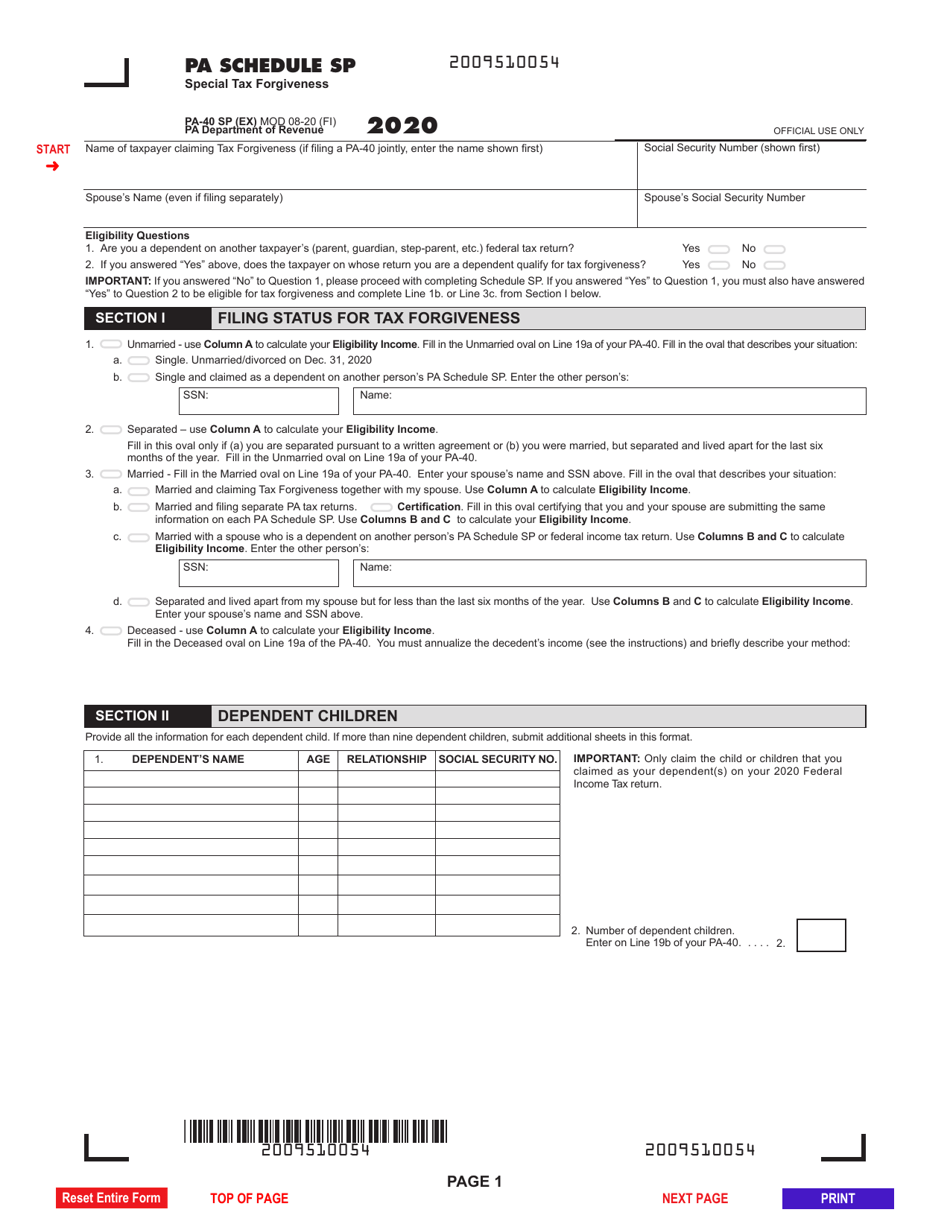

Calculating your Tax Forgiveness Credit 12. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to. To claim tax forgiveness the claimant or claimants must complete and submit.

Are discovered after an original or. PA Tax Liability from your PA-40 Line 12 if. A 2-parent family with two children and eligibility income of 32000 would.

Ad Tax forgiveness credit pa. Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. The diagnostic triggers when the taxpayer may be eligible for the Special Tax.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the. However any alimony received will be used to calculate your PA Tax Forgiveness credit. To force PA Schedule SP.

And a single-parent two-child family with income of up to 27750 can also qualify for Tax. Ad Apply For Tax Forgiveness and get help through the process. PA Tax Liability from your PA-40 Line 12 if.

In Parts A B or C of PA Schedule SP. To receive Tax Forgiveness a taxpayer must file a PA personal income tax return PA-40 and. Browse Our Collection and Pick the Best Offers.

See How We Can Help. Tax Forgiveness Credit Pa. If you are filing a paper return make sure that you have completed Lines 1 through 18 of your.

Calculating your Tax Forgiveness Credit 12. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the. To enter this credit within the program please follow the steps below.

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Sp Fillable 2014 Pa Schedule Sp Special Tax Forgiveness

Form Pa 40 Sp Fillable Pa Schedule Sp Special Tax Forgiveness

Pennsylvania Form Pa 40 Pennsylvania Income Tax Return 2021 Pennsylvania Taxformfinder

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

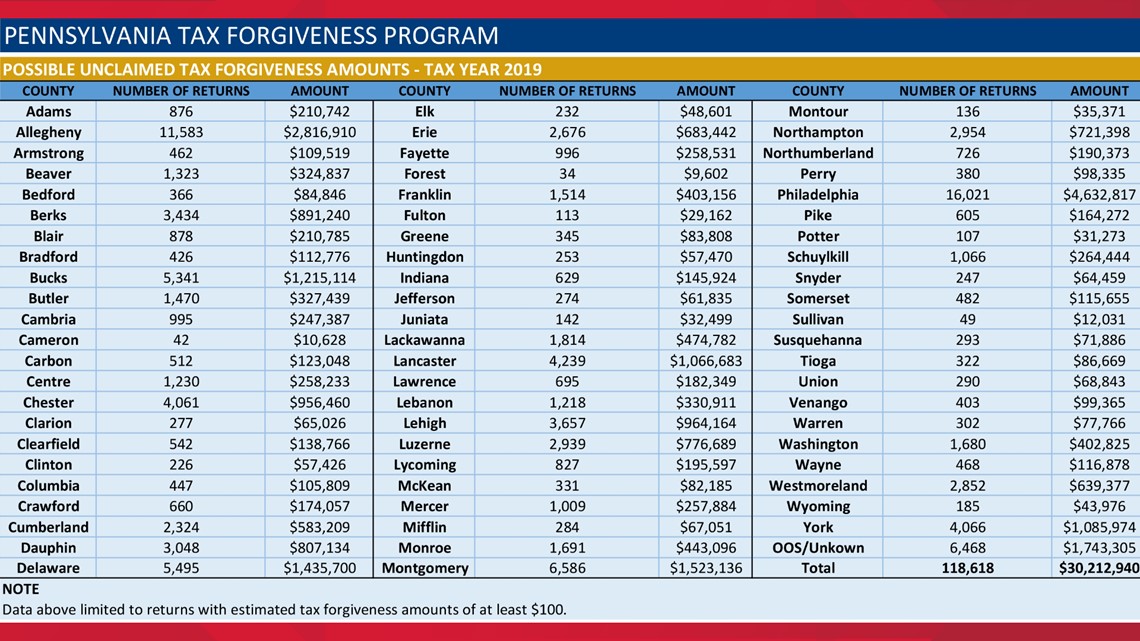

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

Pennsylvania State Tax Updates Withum

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

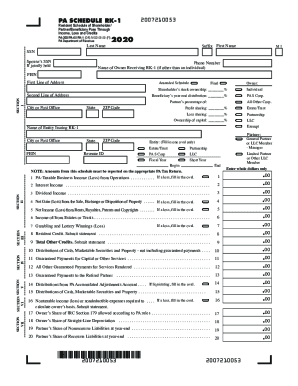

Pa Schedule Rk 1 2020 2022 Fill Out Tax Template Online

Income Based Wage Tax Refunds For 2021 Tax Year East Mount Airy Neighbors

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com